10 Essential Tips for First-Time Homebuyers

Buying your first home is an exciting and significant milestone in your life. It marks the beginning of a new chapter and a place to call your own. However, the process of purchasing a home can be overwhelming, especially for first-time homebuyers. There are numerous factors to consider, financial decisions to make, and a lot of paperwork to handle. To help you navigate this journey smoothly, we’ve compiled a list of 10 essential tips for first-time homebuyers.

- Assess Your Financial Situation

Before you start searching for your dream home, take a close look at your finances. Determine how much you can comfortably afford to spend on a home. Consider your monthly income, expenses, and any outstanding debts. It’s crucial to remember that when budgeting for home buying, there are additional costs beyond the down payment, such as closing costs, property taxes, and maintenance expenses. Establishing a budget for home buying is an important step to ensure you make a well-informed and financially responsible decision

- Save for a Down Payment

One of the most significant financial hurdles for first-time homebuyers is saving for a down payment. The amount required can vary, but generally, a 20% down payment is recommended to avoid private mortgage insurance (PMI). Start saving early and explore different savings strategies like automatic transfers to a dedicated savings account or cutting unnecessary expenses.

- Check Your Credit Score

Your credit score plays a crucial role in determining your eligibility for a mortgage and the interest rate you’ll receive. Obtain a copy of your credit report and review it for any errors or discrepancies. If your score is lower than you’d like, take steps to improve it, such as paying down debts and making payments on time. A higher credit score can save you money in the long run.

- Get Pre-Approved for a Home Loan

Before you start house hunting, getting pre-approved for a home loan is a good idea. This process involves a lender reviewing your financial information and determining how much they will lend you. Having a pre-approval letter in hand strengthens your position as a buyer and helps you narrow your search for homes within your budget.

- Define Your Priorities

Make a list of your must-haves and nice-to-haves in a home. Consider factors such as location, size, layout, and amenities. Be realistic about your priorities and willing to compromise on some aspects. This list will serve as a valuable guide during your home search and help you focus on properties that align with your needs and preferences.

- Research the Neighborhood

The location of your future home is just as important as the property itself. Research the neighborhoods you’re interested in, considering factors like infrastructure and accessibility, safety, schools & colleges, proximity to work, essential services like hospitals, clinics, and emergency services, and other local amenities. Conducting thorough research and considering all these factors, you’ll be better equipped to make an informed decision

- Work with a Real Estate Agent

A skilled real estate agent can be a tremendous asset for first-time homebuyers. They have in-depth knowledge of the local market, can guide you through the home buying process, and negotiate on your behalf. Interview potential agents to find one who understands your needs and has a proven track record of helping first-time buyers.

- Don’t Skip the Home Inspection

Once you’ve found a property you love, take your time making an offer with a thorough home inspection. A qualified inspector will assess the home’s condition, including its structure, systems, and potential issues. This step can help you avoid unpleasant surprises down the road and give you leverage for negotiations if necessary.

- Understand the Closing Process

The closing process involves finalizing the sale and transferring ownership of the property. It includes reviewing and signing various documents, paying closing costs, and obtaining homeowner’s insurance. Familiarise yourself with the process, and feel free to ask questions if something needs clarification. Being well-informed will make the closing process smoother and less stressful.

- Plan for the Future

When purchasing your first home, think about your long-term goals. Are you planning to stay in this home for many years, or is it a stepping stone to a larger property? Consider how the home will meet your needs in the future and whether it has the potential for higher resale value. Planning for the future can help you make a more informed decision.

In conclusion, buying your first home is a significant step that requires careful planning and consideration. By assessing your finances, saving for a down payment, improving your credit score, and working with professionals, you can confidently navigate the homebuying process. Defining your priorities, researching neighborhoods, and conducting a thorough home inspection will ensure you find the right property for your needs. Finally, understanding the closing process and planning for the future will set you up for a successful homeownership experience.

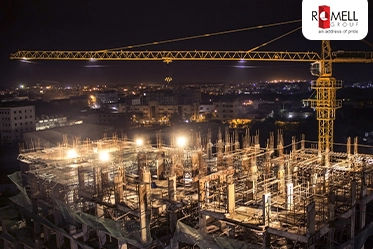

At Romell Group, we understand the importance of this milestone in your life, and we’re here to assist you every step of the way. Our experienced team of real estate professionals is dedicated to helping first-time homebuyers find their dream homes. Contact us today to start your journey toward homeownership, and let us guide you through the process with expertise and care. Your dream home is closer than you think!